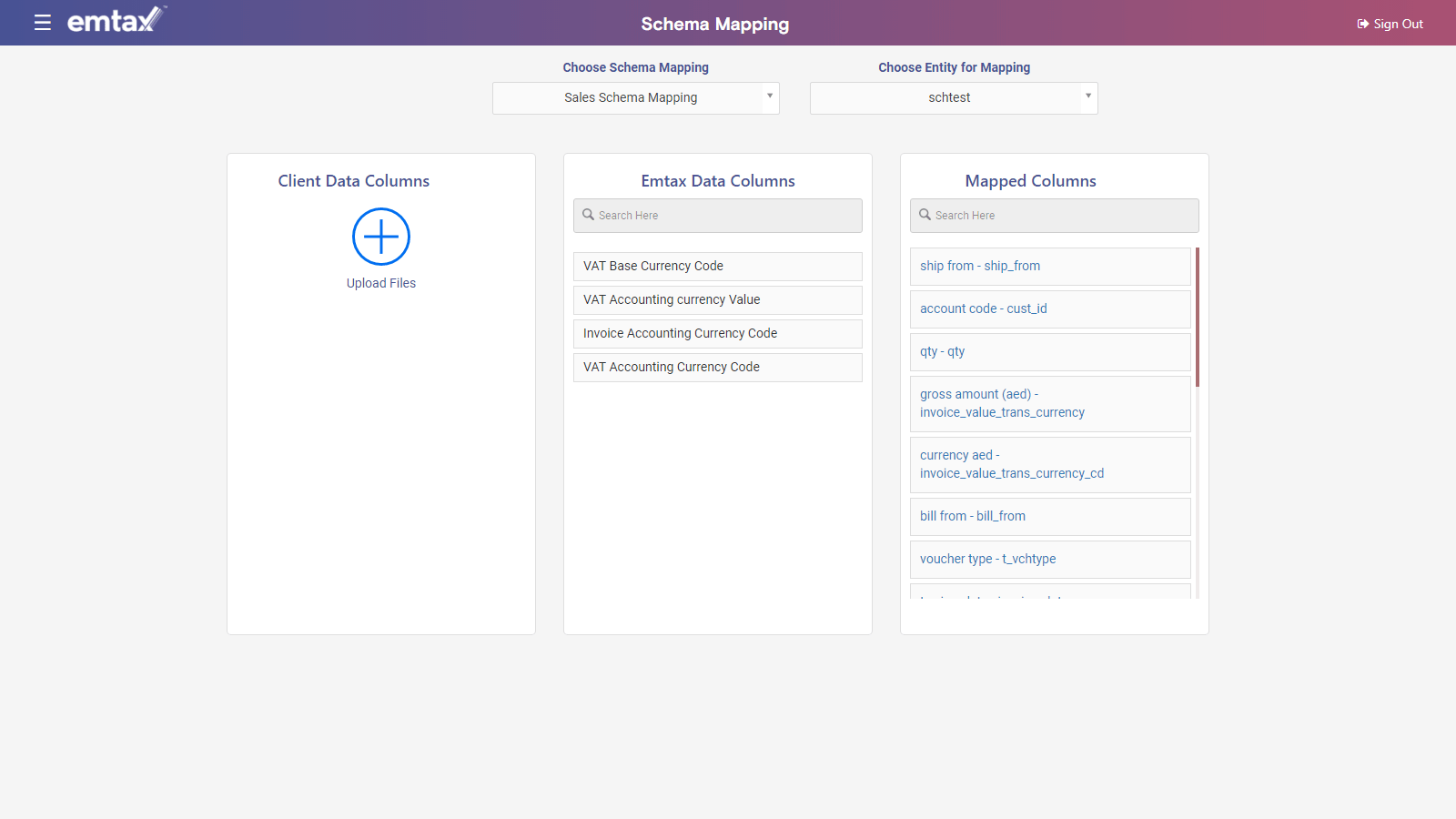

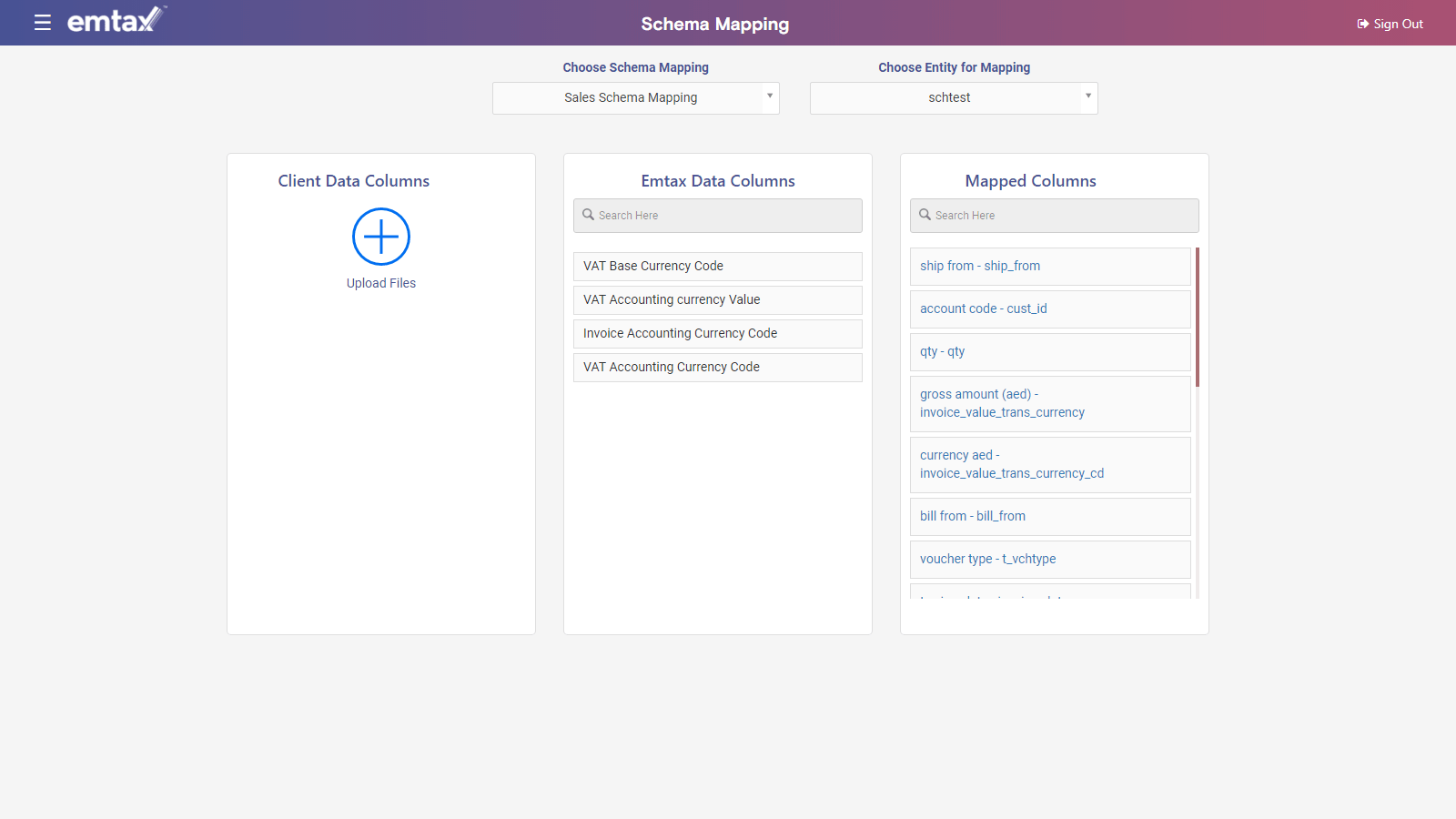

The system is designed to accept different data sources with a simple configuration step.

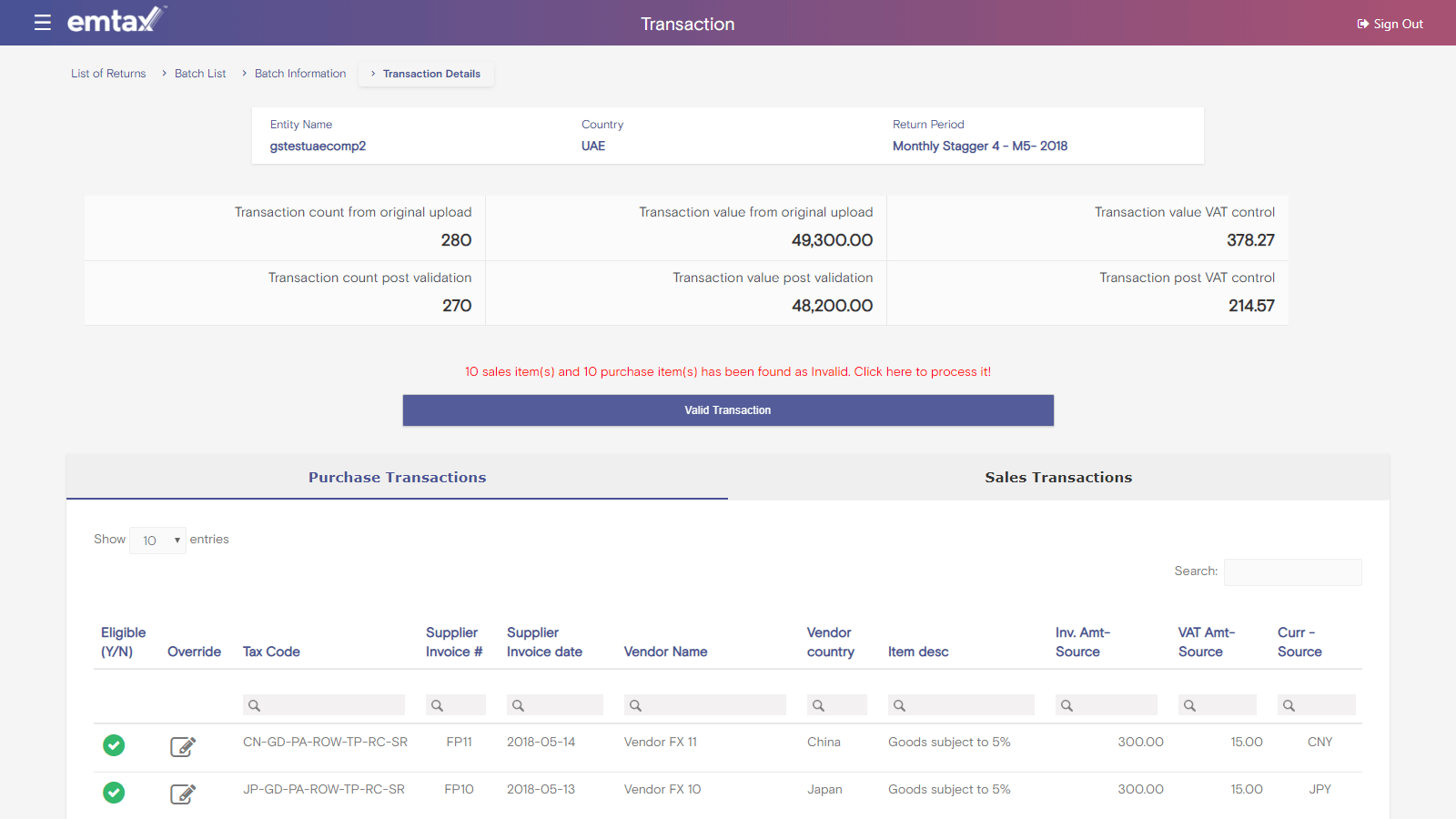

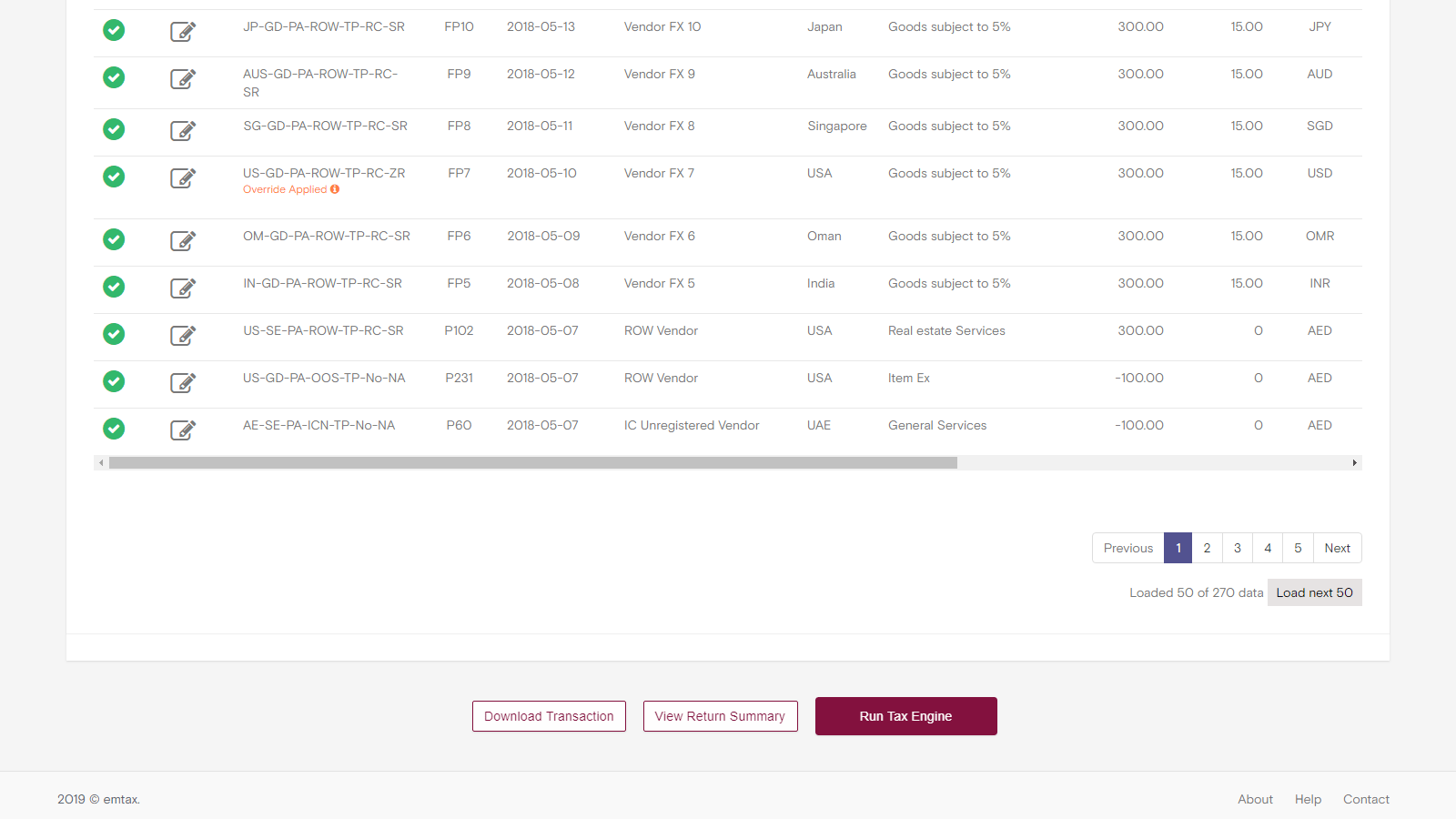

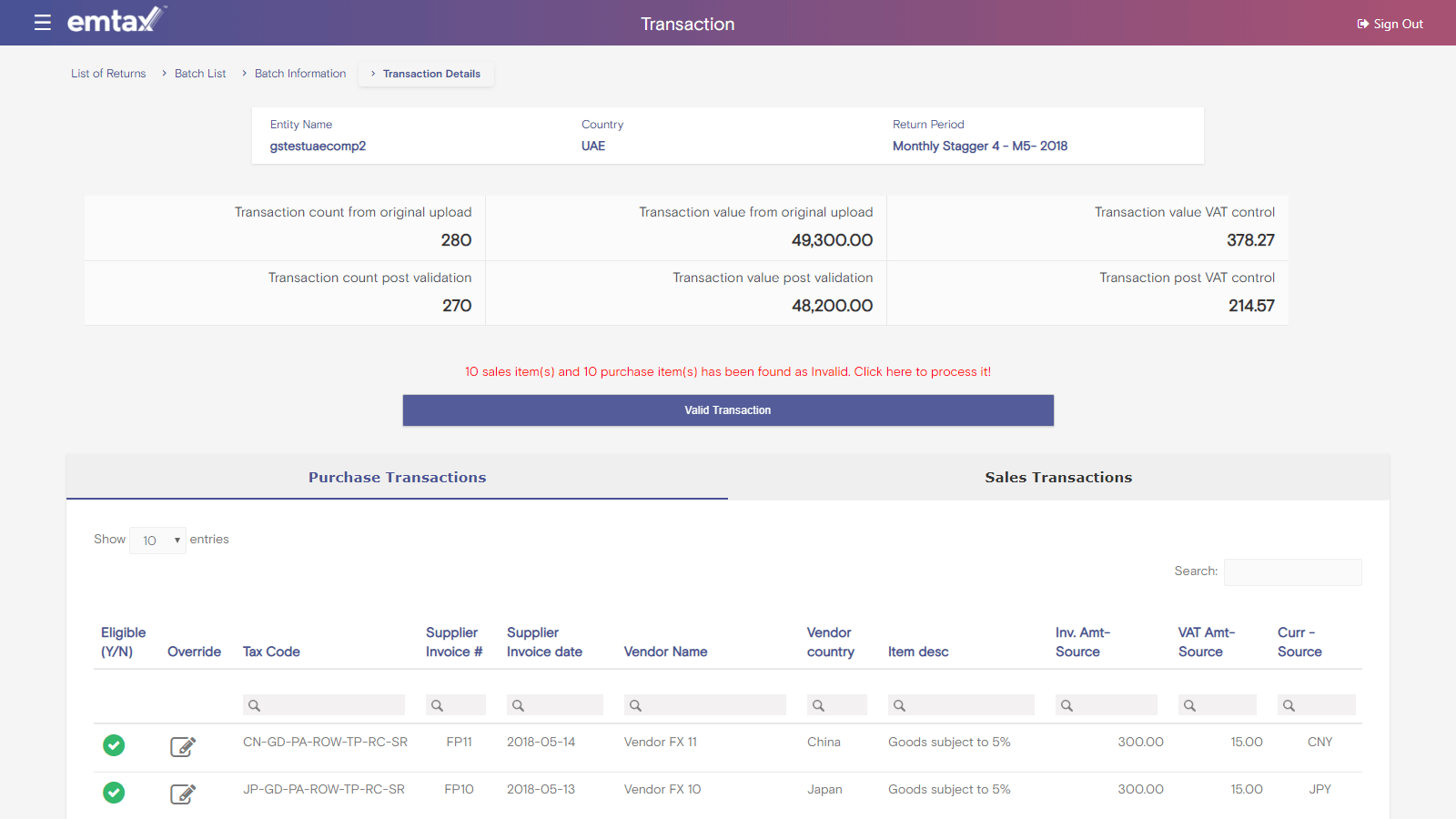

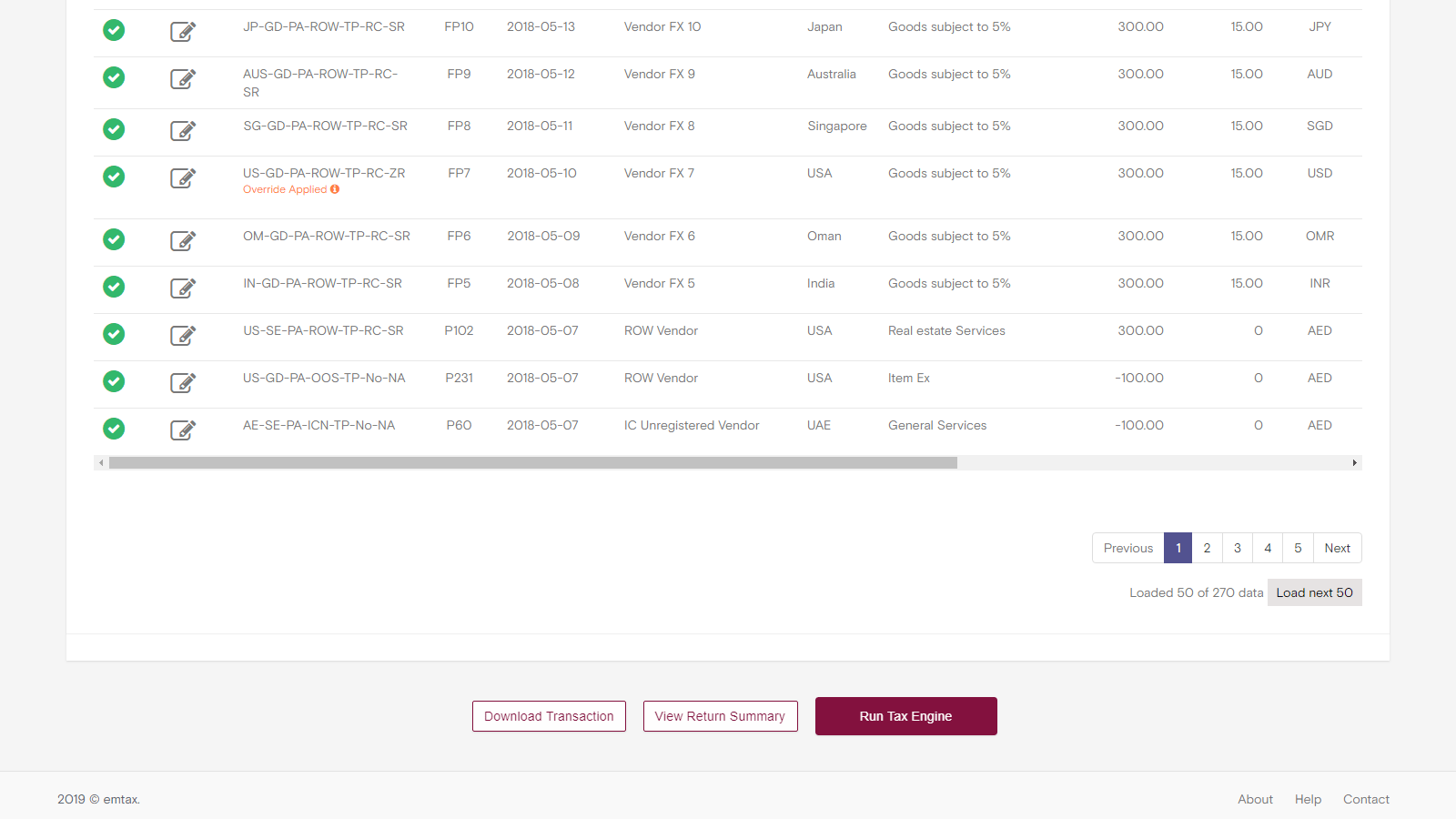

Data is validated using precise structural and logical parameters.

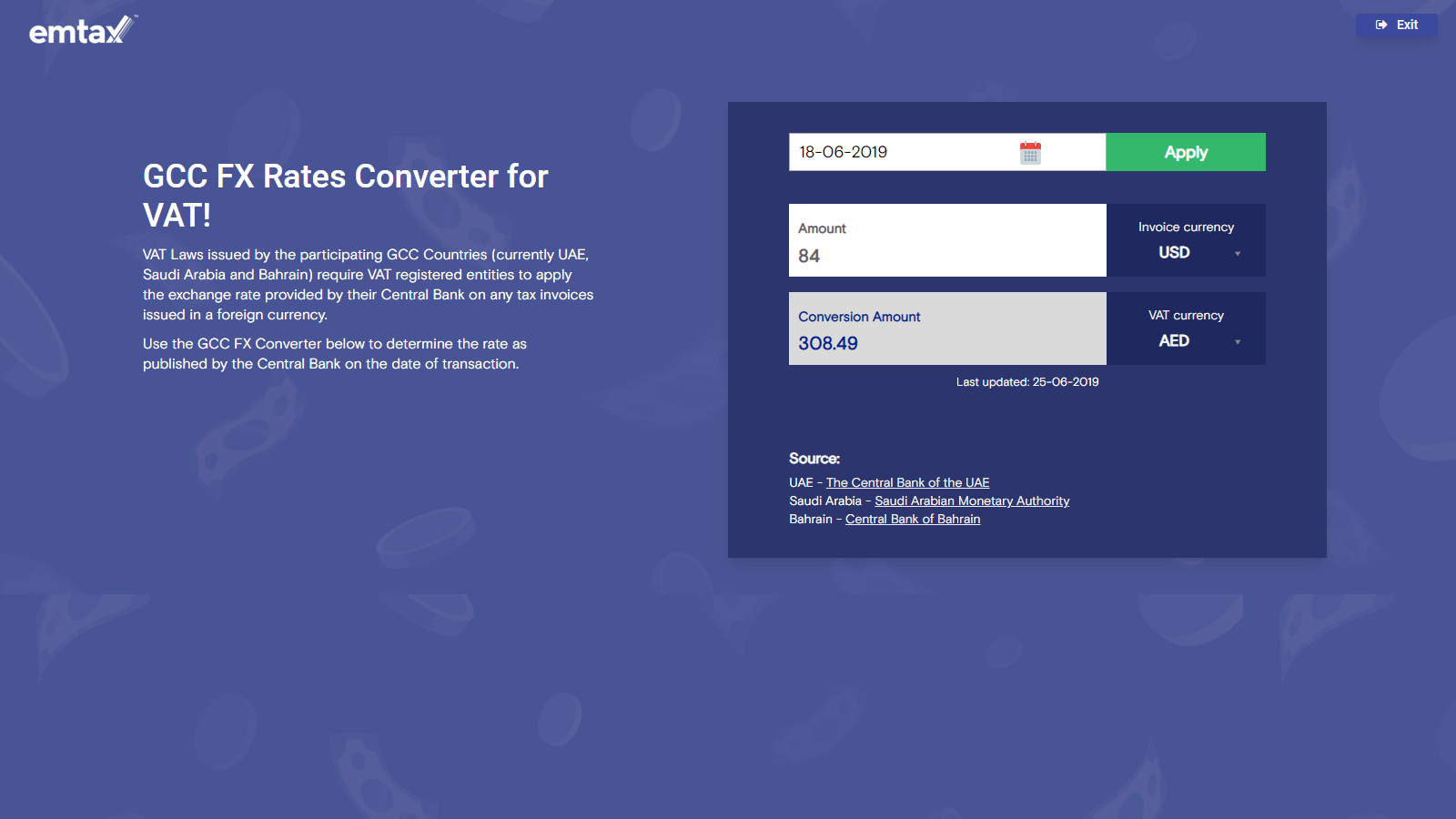

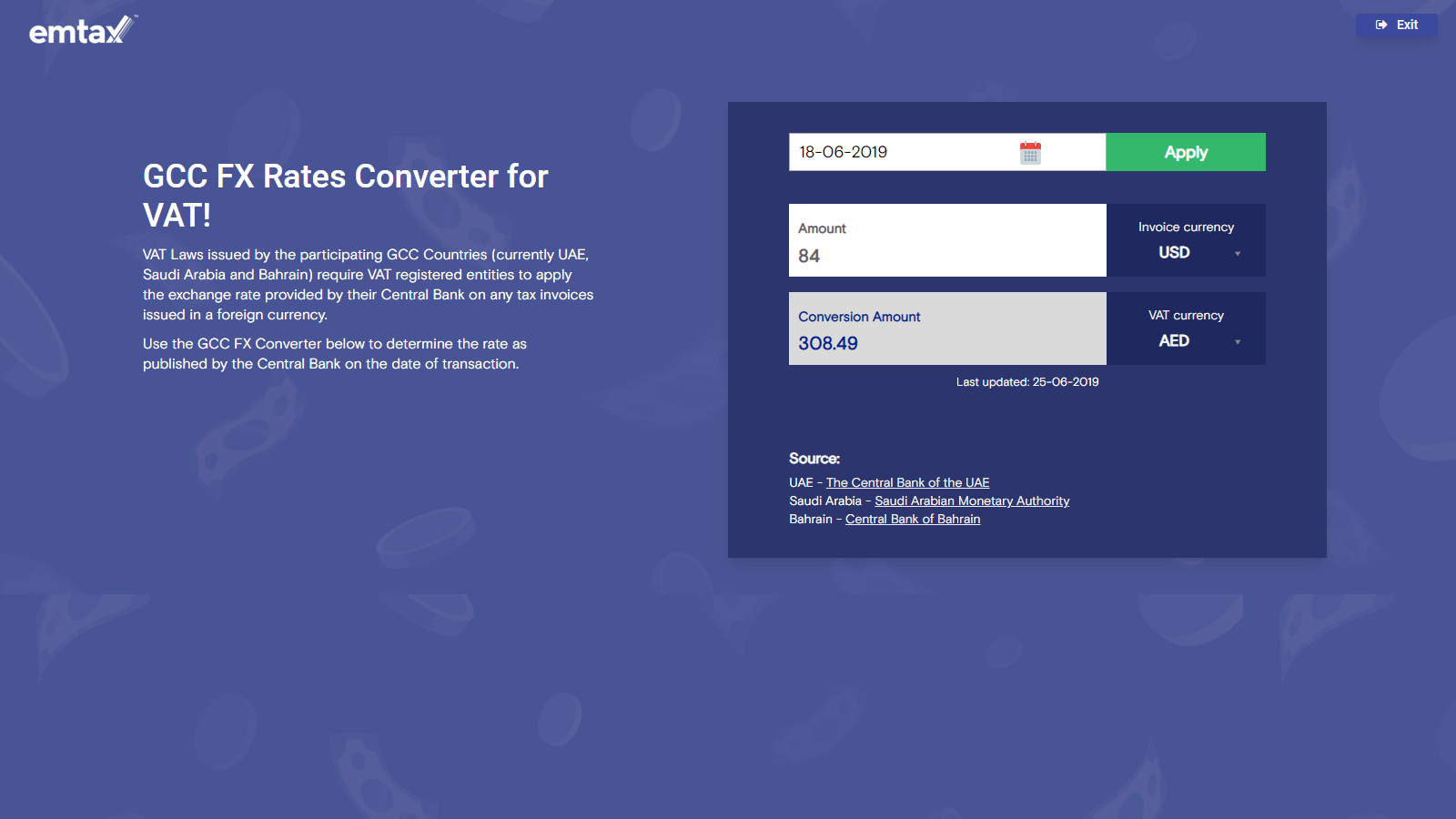

We’ve bundled the latest tax rates and rules into the emtax Engine. So you don’t have to deal with the nitty gritties.

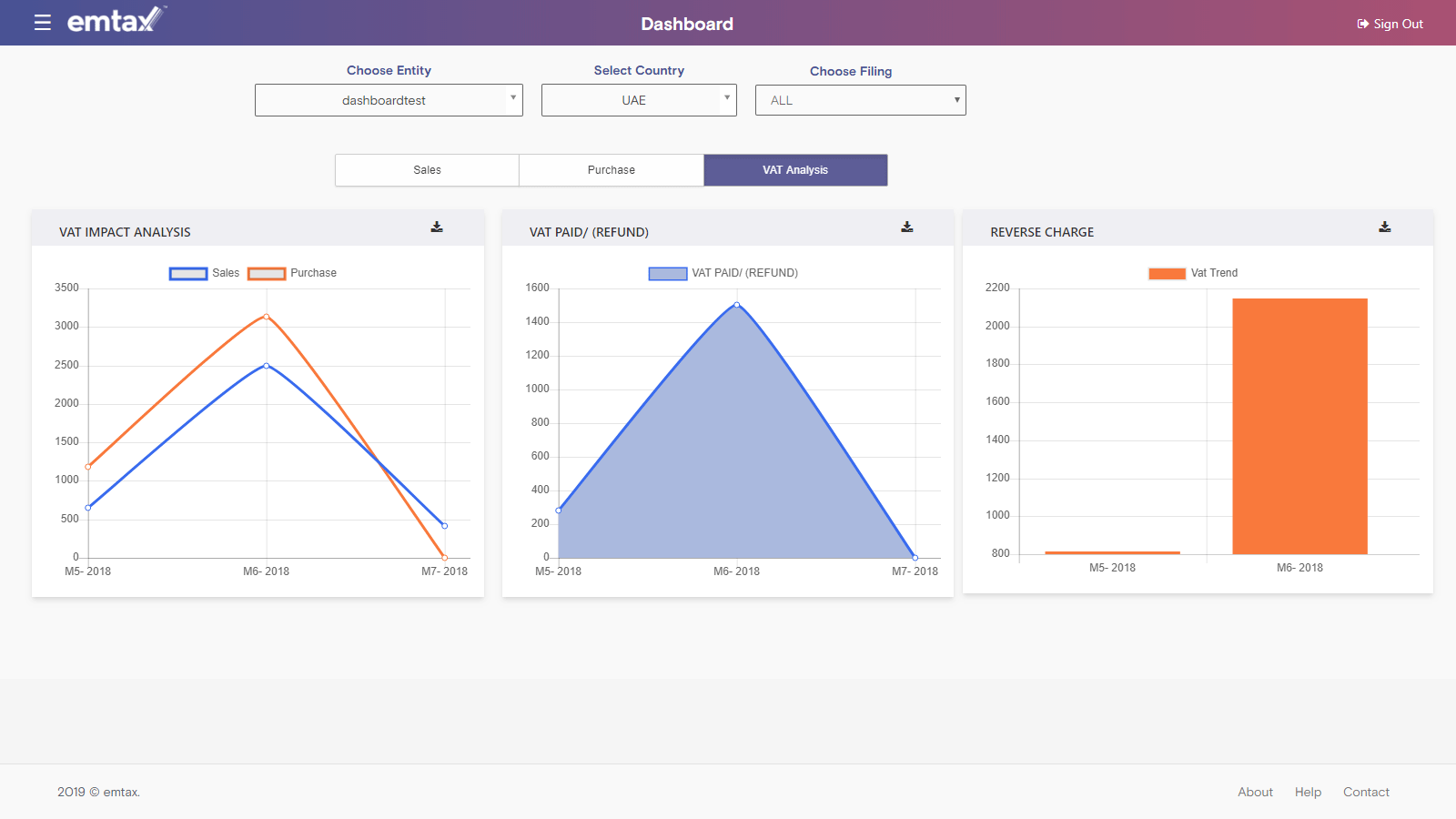

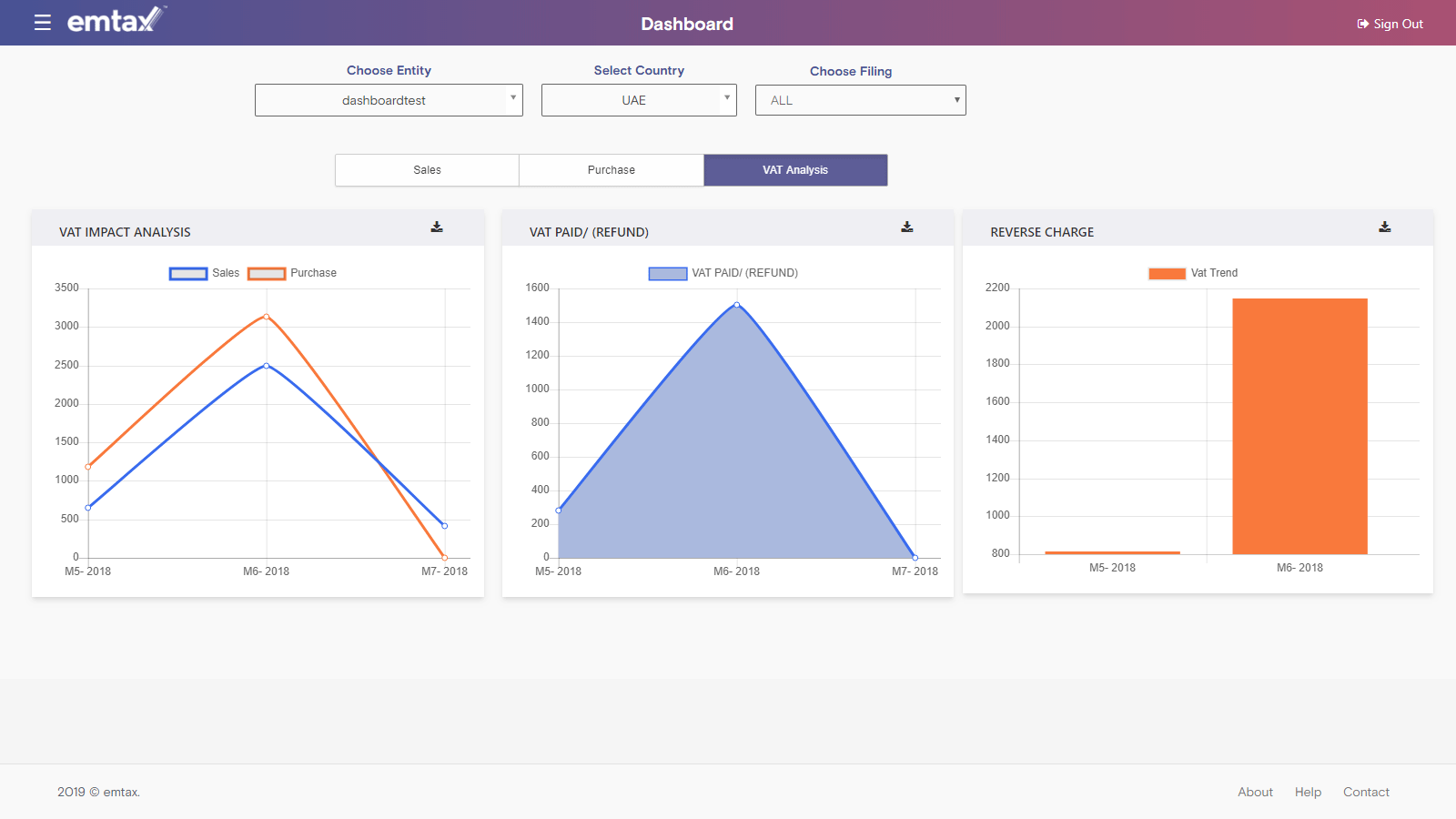

From standard analytics to self-service reporting, the Analytics module is scalable to meet the requirements of different types and size of companies.

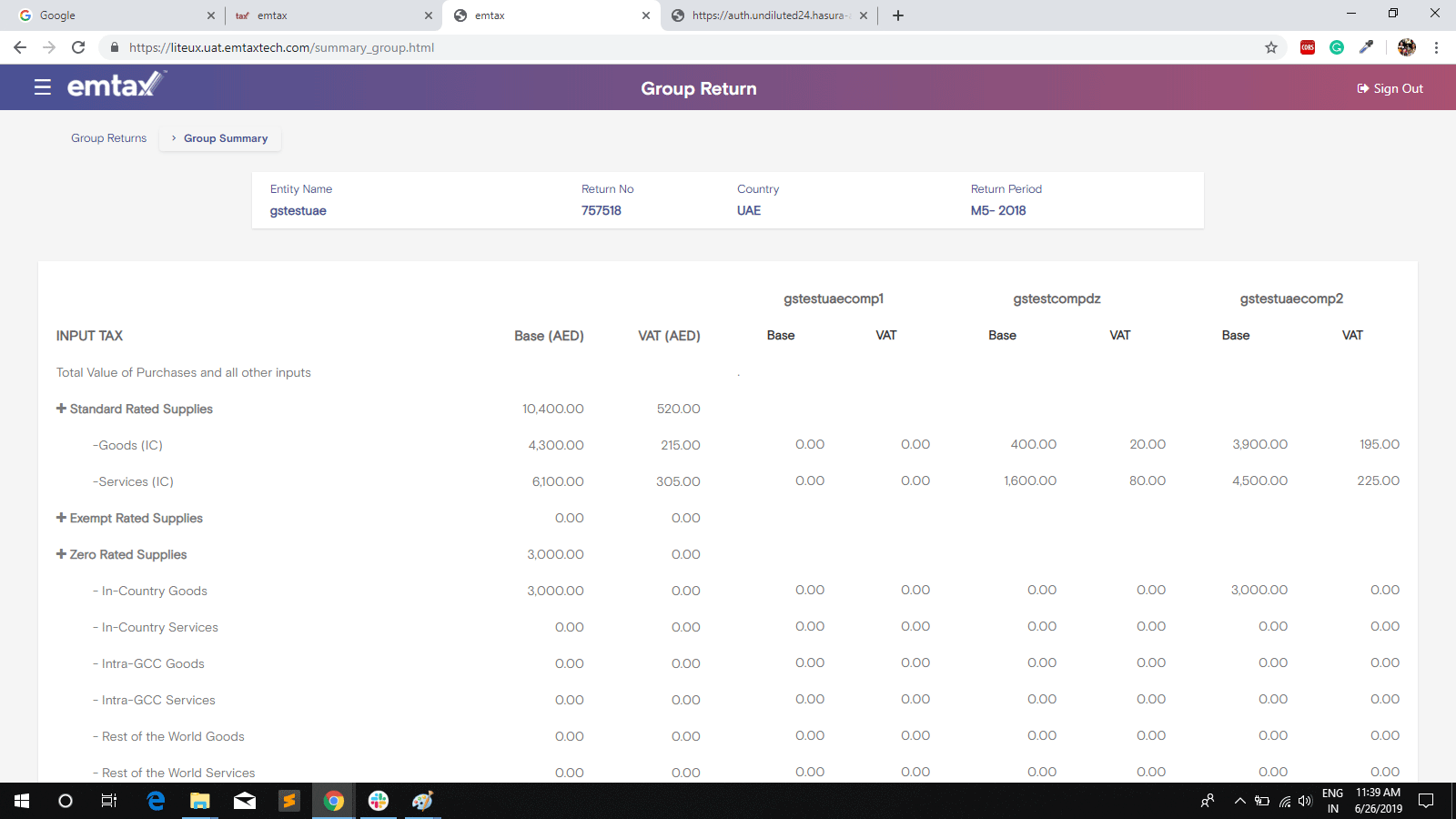

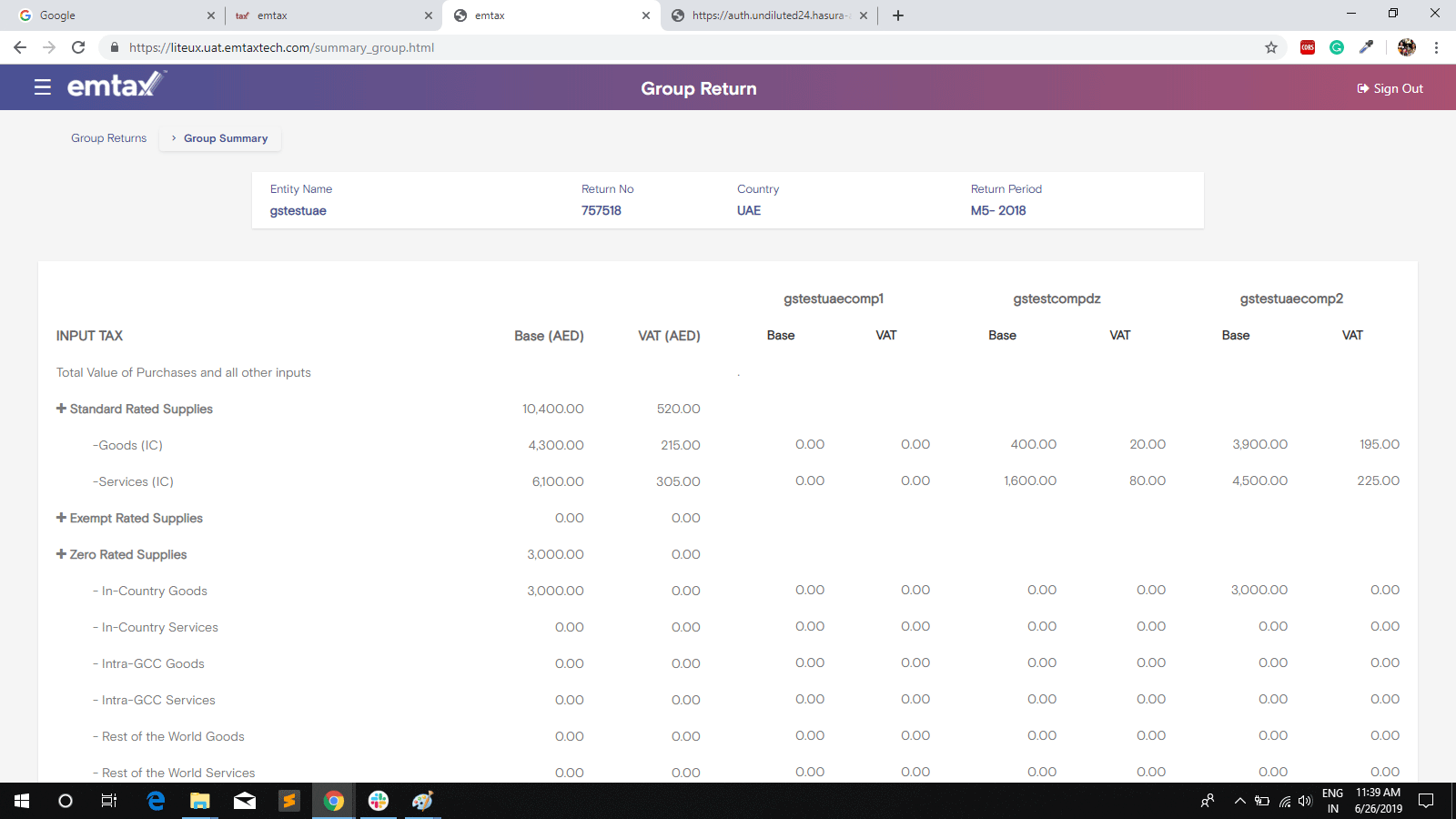

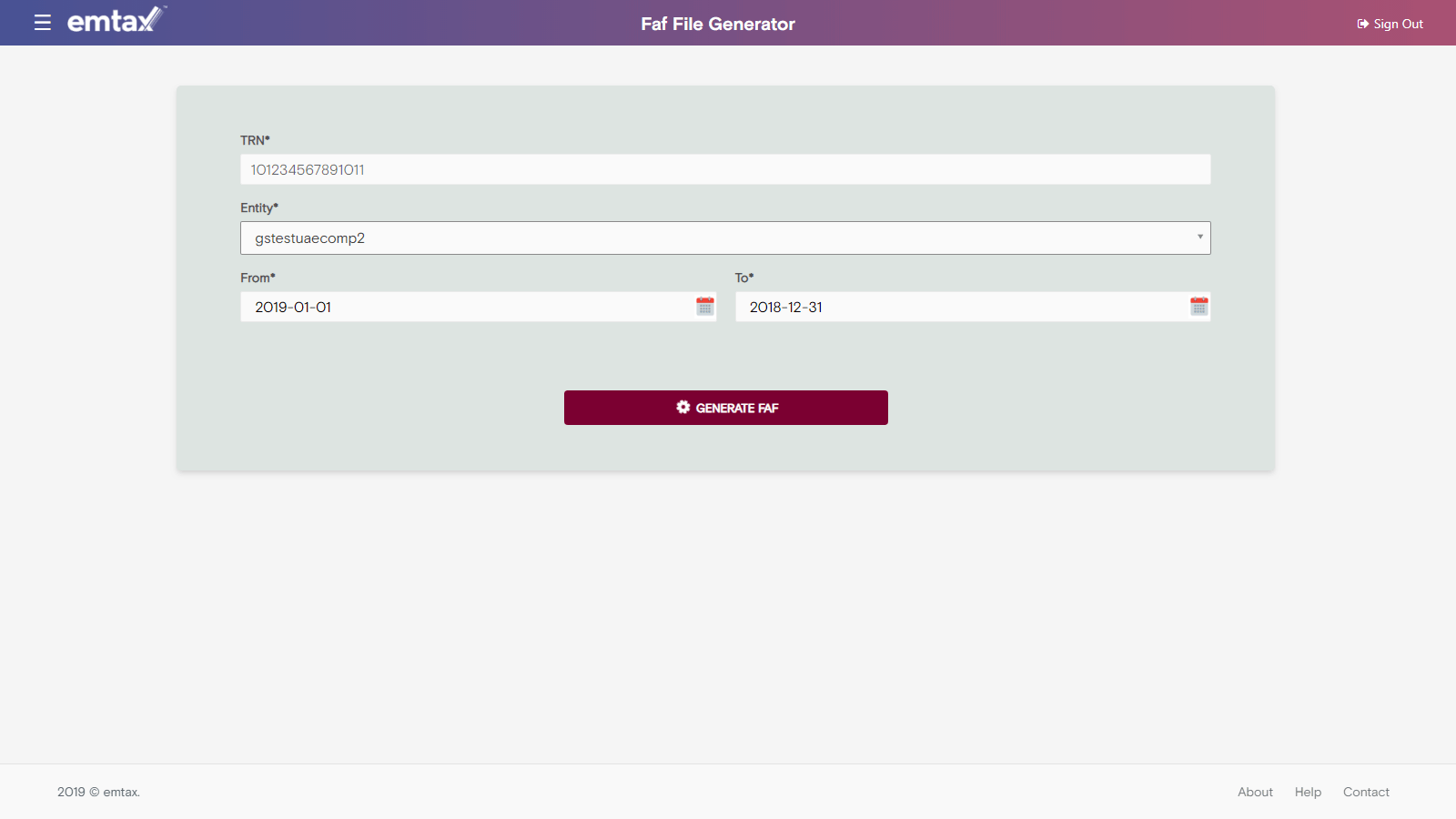

Designed for organizations with multiple legal entities that have a single VAT registration.

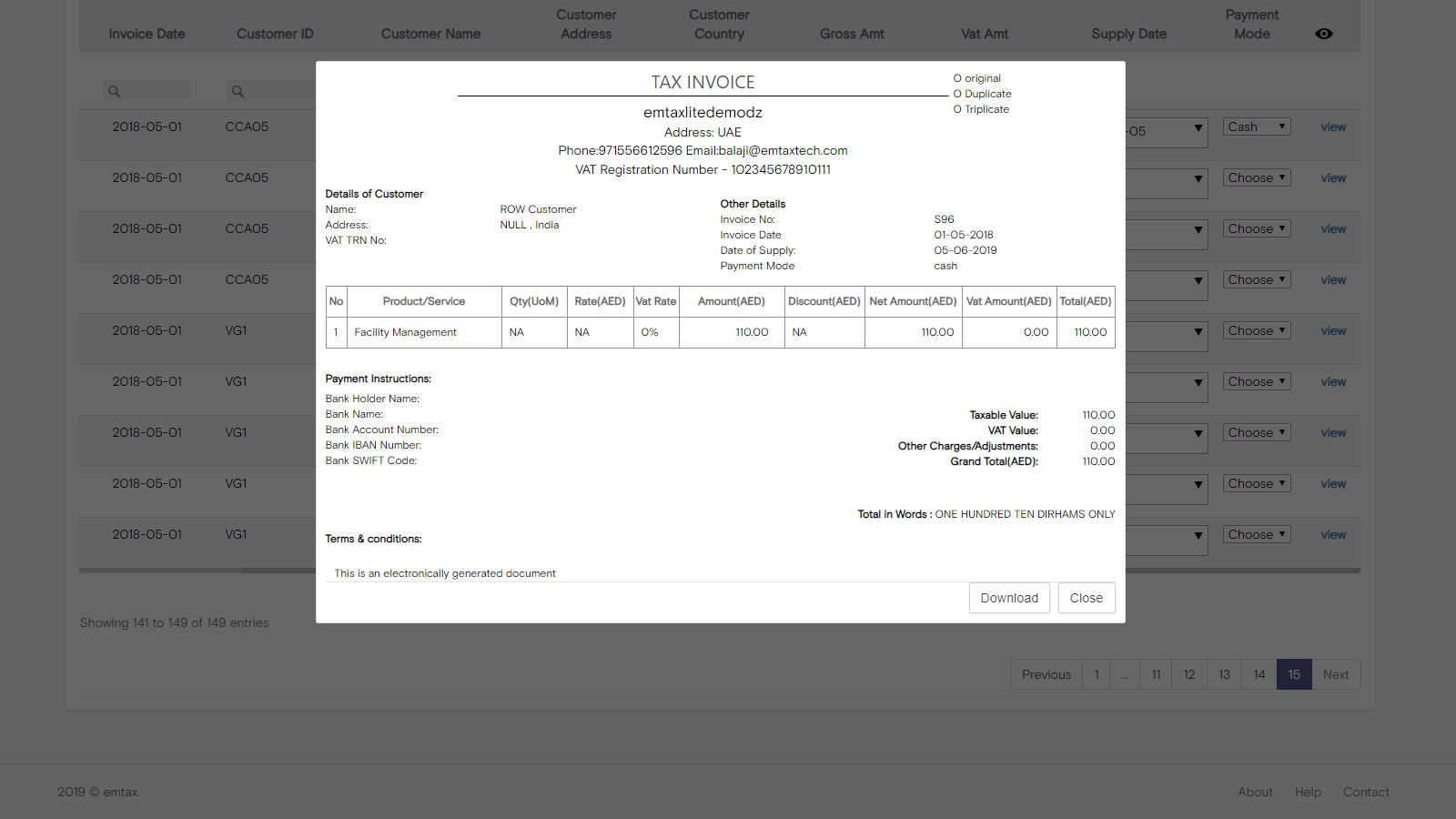

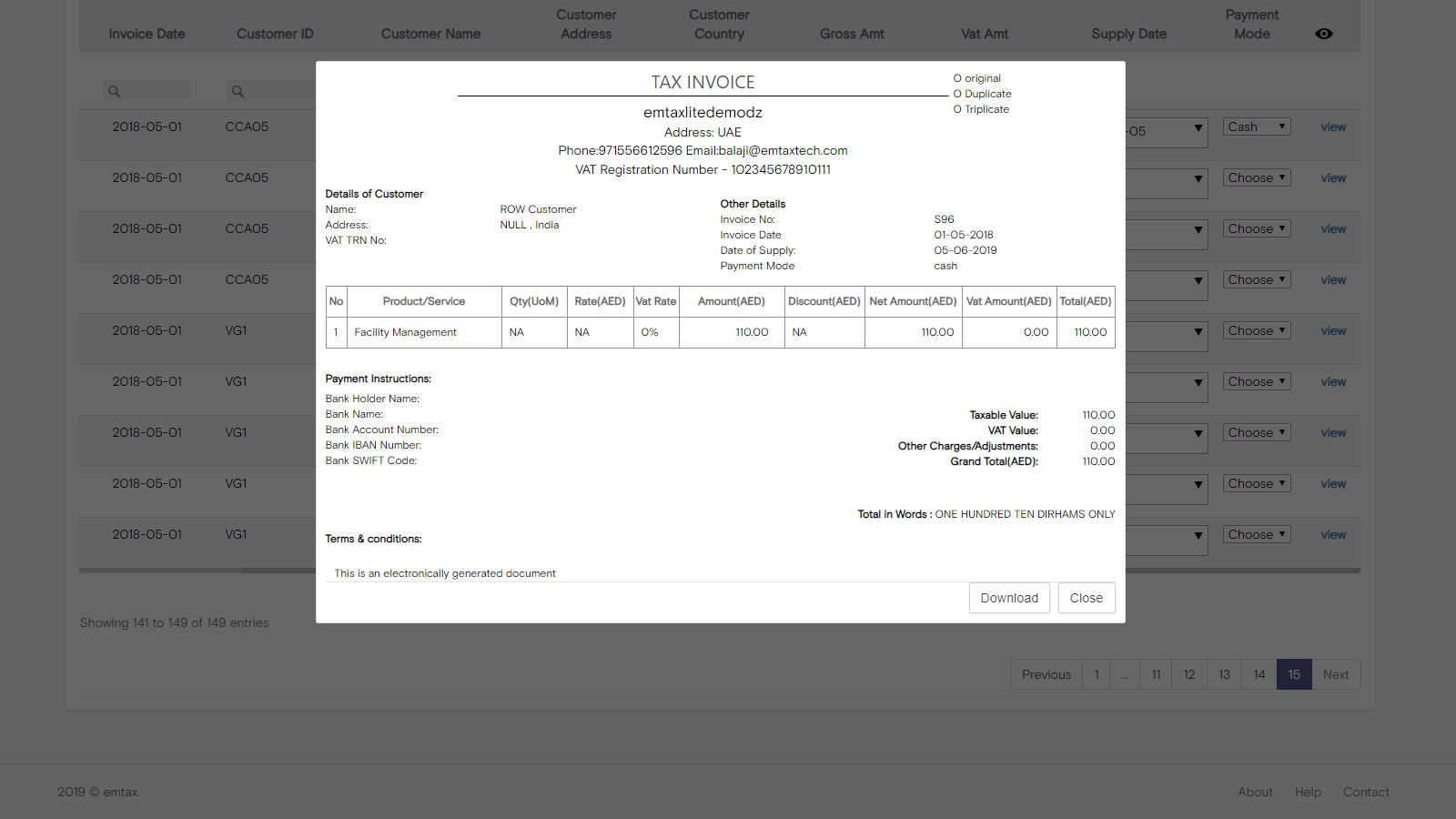

Emtax has several tax compliance features to help companies manage the VAT compliance process efficiently.

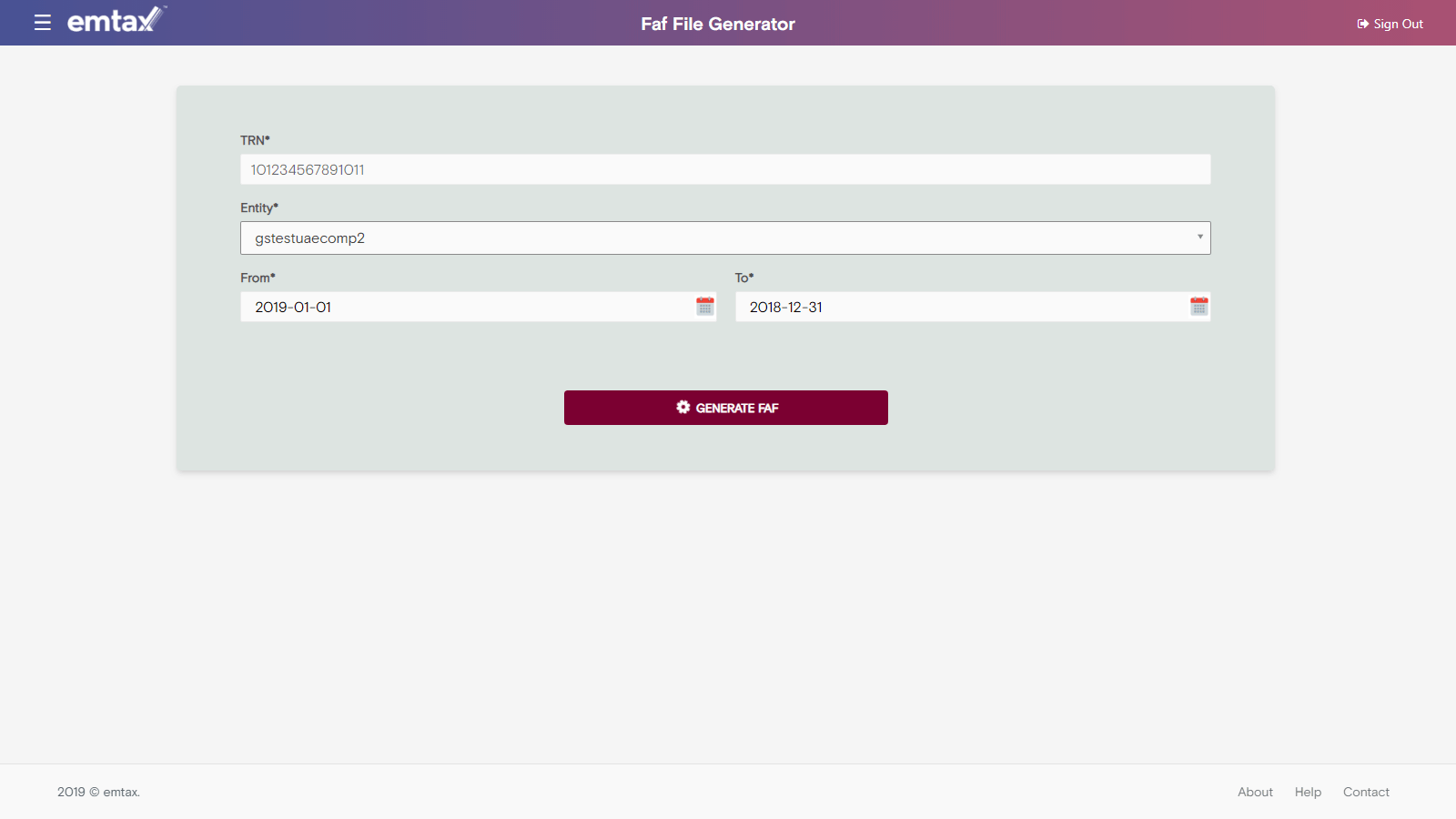

Using emtax gives users the ability to automate tax decisions, eliminate error prone manual processes, and reduce the need for non-tax resource assistance.

The system is designed to accept different data sources with a simple configuration step.

Data is validated using precise structural and logical parameters.

We’ve bundled the latest tax rates and rules into the emtax Engine. So you don’t have to deal with the nitty gritties.

From standard analytics to self-service reporting, the Analytics module is scalable to meet the requirements of different types and size of companies.

Designed for organizations with multiple legal entities that have a single VAT registration.

Emtax has several tax compliance features to help companies manage the VAT compliance process efficiently.

Using emtax gives users the ability to automate tax decisions, eliminate error prone manual processes, and reduce the need for non-tax resource assistance.